House prices RISE after three months of falls – but Nationwide warns that the future of the housing market is uncertain

London house prices rose at the slowest annual pace since 2012

HOUSE prices in the UK bounced back in June, erasing the decline recorded over the previous three months - the longest sustained fall since 2009.

Nationwide, one of the biggest mortgage providers, said that house prices increased by an average of about 1.1 per cent in June – the first rise in four months.

Annual house price growth - which gives a better sense of the underlying trends – continued pointing to modest gains as it edged up to 3.1 per cent from 2.1 per cent in May, above the consensus.

Despite the uptick, Nationwide’s chief economist warned that monthly growth rates can be “volatile, even after accounting seasonal effects.”

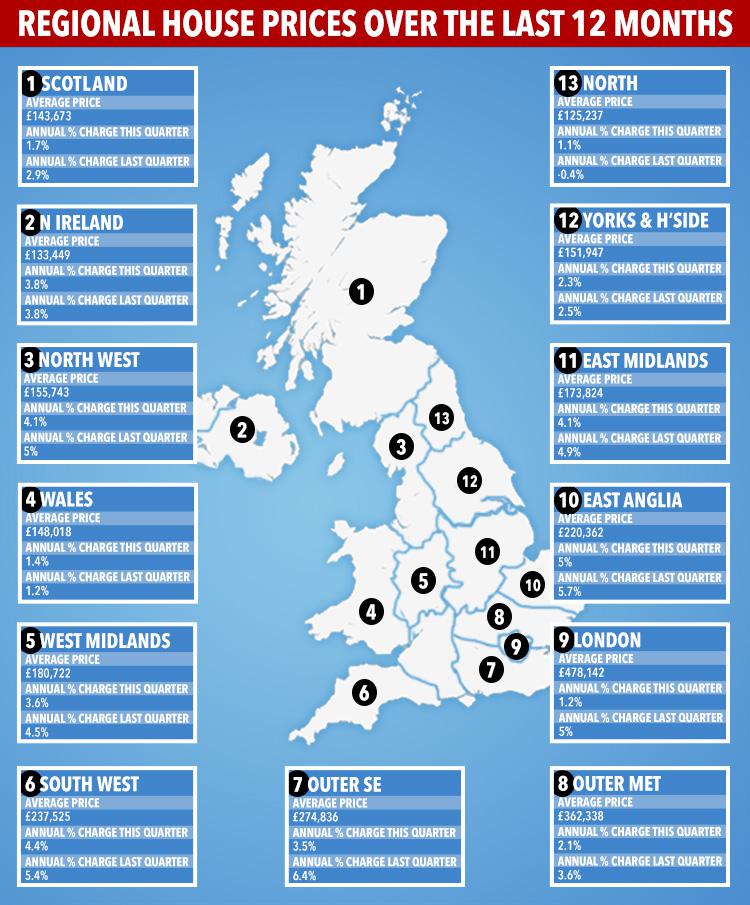

In the South East of England and London, house prices continued to slow when compared to the rest of the UK.

London house prices saw a particularly strong slowdown, with annual price growth slowing to just 1.2 per cent - the slowest annual pace of growth in the capital since 2012.

Nationwide’s latest data comes as other house measures have shown prices dropping since Britain voted for Brexit almost a year ago.

Earlier this month, the mortgage lender reported three successive monthly falls in house prices for the first time since 2009 – the peak of the financial crisis.

Prices fell 0.2 per cent in May, 0.4 per cent in April, and 0.3 per cent in March.

Rival bank Halifax said house price growth slipped to a four-year low in May.

Property website Rightmove also said average asking prices for property sold on its website dropped 0.4 per cent in June.

What will happen to house prices in the future?

Property experts seem to agree that although the return to growth as seen in Nationwide's data is welcome, it is also likely to be short-lived.

Robert Gardner from Nationwide says that so far it remains unclear whether the increase in house price growth in June reflects strengthening demand conditions on the back of healthy gains in employment and continued low mortgage rates.

Or whether the lack of homes on the market is the more important factor.

“Given the ongoing uncertainties around the UK’s future trading arrangements, the economic outlook remains unusually uncertain, and housing market trends will depend crucially on developments in the wider economy,” Mr Gardner said.

He added that Nationwide expects that the double whammy of rising inflation and housing affordability pressures in key parts of is likely to drag on housing market activity and house price growth in the quarters ahead.

Jonathan Hopper, managing director of Garrington Property Finders, said while the return to a respectable headline growth rate is welcome, it’s more likely to be the product of the chronic lack of supply rather than any acceleration in demand.

Mr Hopper said: “The affordability squeeze remains a major concern. With consumer prices now rising at 2.9 per cent a year – and far outstripping wage growth – people’s level of disposable income is shrinking even as house prices march upwards.

“As the gap between the two grows to untenable levels, some would-be buyers will either give up or the market will correct itself by restricting rates of house price inflation.

“We’re now at a tipping point – where buyers have become intensely price-sensitive and pragmatic sellers are often willing to trade price reductions for the certainty of a sale.”

Hannah Maundrell, Editor-in-Chief of money.co.uk advised future home buyers to make sure they do their research and haggle to get a price they’re happy with.

She said: "If you want to sell at the top end of the price scale you’ll need to make sure your home is better than anything else out there, and be prepared to wait for someone that wants to pay a premium."

How to get help buying a house

THERE are several government schemes available to help you get on the housing ladder.

- Help to Buy loan: This scheme is for those who have a 5 per cent deposit, and is only available on new-build properties that are worth less than £600,000. The government lends you up to 20 per cent of the property value (interest-free for the first five years) which gives you access to cheaper mortgages. You will need to pay this back at the end of the mortgage or when you sell.

- Starter Homes: First-time buyers under the age of 40 can access this new scheme. You’ll get a 20 per cent discount on the market value of the property (new-build only) but you cannot sell or let the property for five years after you buy it.

- Shared ownership: This scheme is available to non-homeowners who earn £80,000 a year or less (£90,000 in London). People can buy a share of a home from a housing association and continue to rent the remainder. Buyers will need a ten per cent deposit as well as money to cover stamp duty and other fees. You’ll also need to find a mortgage lender that is willing to lend on shared ownership properties

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516