Surveyors warn that house sales are ‘flatlining’ – why is the property market slowing?

As the number of properties on surveyors books falls to a new all-time low, we take a look at how the property market is slowing - and what it means for house prices

The average number of properties on surveyors' books has hit a new all-time low, a report has found.

Just over 42 homes were available for sale per branch on average in June, the Royal Institution of Chartered Surveyors (Rics) said.

The number of fresh homes coming to market had fallen for 16 months in a row - and "against this backdrop, average stock levels have slipped to a new low" - Rics, whose survey started in 1978, said.

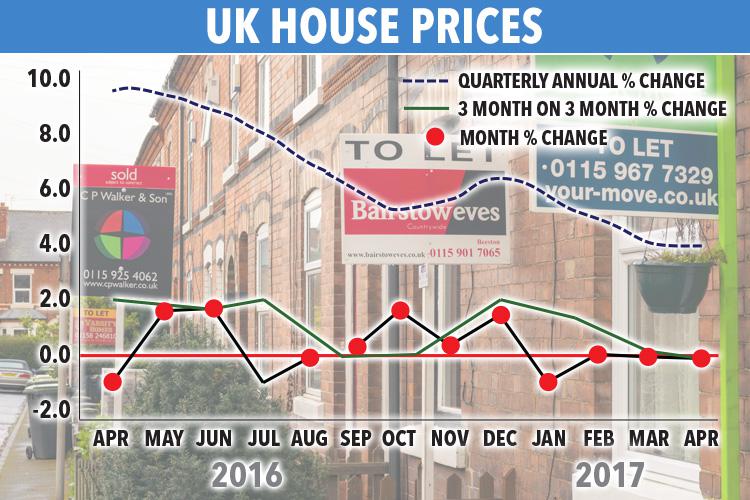

House prices continued to push upwards in June, but the pace of growth had slowed.

A net balance of 7 per cent of surveyors across the UK saw prices rise rather than fall in June, but in May more surveyors had been seeing prices increase, with an overall balance of 17 per cent.

In central London the pace of decline in house price inflation continued, with 45 per cent more surveyors seeing a decline in prices over the month while the South East and East Anglia were showing a flatter trend, Rics said.

Surveyors' expectations for house sales in the coming 12 months had fallen to their weakest levels since the aftermath of the vote to leave the EU in 2016, Rics said.

Despite the increased sense of caution, overall, a net balance of 12 per cent of surveyors still expected to see an increase in sales in the coming year rather than a fall.

MOST READ IN MONEY

Simon Rubinsohn, chief economist at Rics, said: "The latest results demonstrate the danger, however tempting, of talking about a single housing market across the country.

"Rics indicators particularly regarding the price trend are pointing towards an increasingly divergent picture.

"High-end prime properties may be seeing prices slipping back but, for good or ill, prices are continuing to move higher in many other segments of the market."

Mr Rubinsohn said sales were "flatlining" and may continue to do so for a while, "particularly given ongoing challenge presented by the low level of stock on the market."

Why is the housing market slowing down?

Property experts seem to agree that the housing market is much quieter than usual.

This due to a combination of factors, including uncertainty following the EU referendum and general election as well as rising inflation putting a squeeze on household finances.

Jeremy Leaf, north London estate agent and a former RICS residential chairman, told The Sun Online: "Nearly all recent market surveys indicate UK house prices are fairly stable but softening in most parts of London.

For more information on house prices - and whether they will rise or fall - visit our dedicated page.

"Many of these reports are fairly historic as what we’re finding ‘on the ground’ is that buyers and sellers must be realistic if they want to do business."

"Affordability issues have become more of an issue to many first-time buyers now that inflation is rising faster than wages and lending criteria remains tight.

"Overall, we’re seeing more balance between supply and demand but don’t expect any major movements one way or the other over the next few months."

But Russell Quirk, found and CEO of online estate agent EMoov, thinks that house price will continue to rise, despite some surveys indicating otherwise.

He told The Sun Online: "The RICS report should be taken with a pretty big pinch of salt really and especially considering that in July 2016 they said much the same thing in terms of a reduction in sentiment yet house prices went on to be some 3 per cent higher a year later.

"Demand for UK housing continues to outstrip a frankly woeful level of supply thanks to successive governments neglecting this issue.

"The consequence though of such neglect is that house prices will continue to rise in the medium and the long term."

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516