Most affordable cities for first-time buyers revealed – but would you move hundreds of miles just to buy a home?

With house prices in the UK continuing to soar, first-time buyers are being forced to move further away to find a home

FIRST-TIME buyers are moving hundreds of miles in order to get on the housing ladder, new research has found.

Seven in ten recent first-time buyers were forced to buy a home outside their original preferred location, a survey has found.

Around 70 per cent of people - who said they've had compromised on location - ended up living nearly half an hour away from where they originally wanted to be, Post Office Money found.

Its survey of more than 1,000 people who got on the property ladder in the last two years found that among those who bought elsewhere, the average length of time to drive from where they had purchased a home to the original location where they had started their house hunt was 26 minutes.

While 16 per cent of first-time buyers said they did not have to adjust their expectations at all.

But others said compromises they had made to get on the property ladder had included being more flexible about a garden, car parking spaces and the structural work needed to the property.

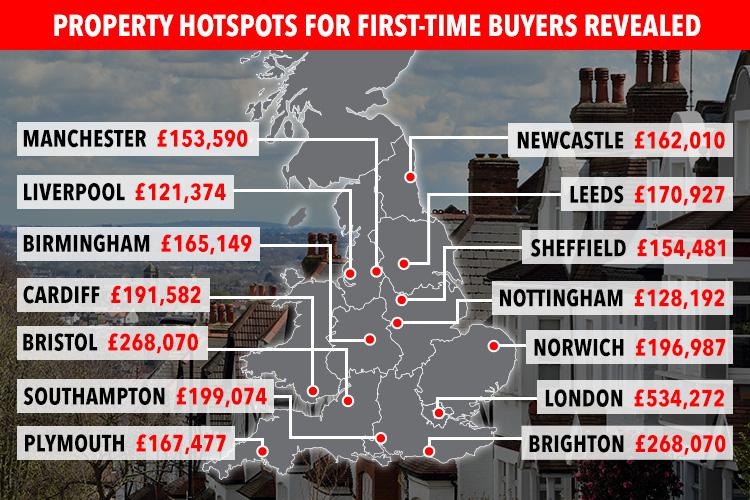

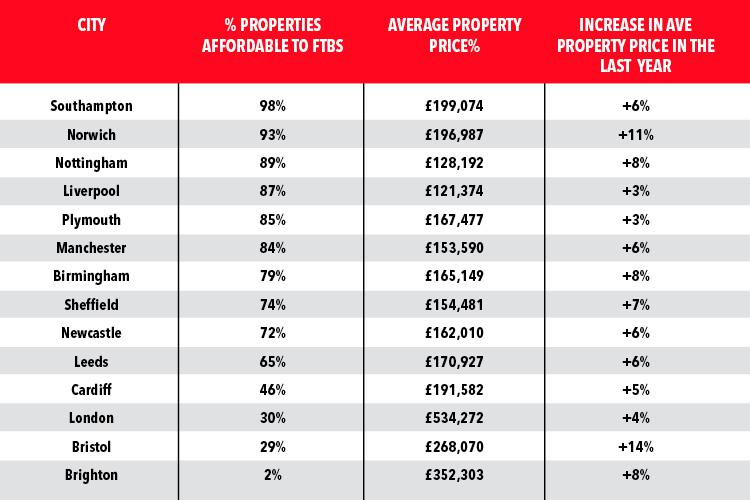

Southampton, Norwich and Nottingham were found to be the most affordable areas for first-time buyers - while those searching in Brighton and London may struggle.

According to analysis which compared average local house prices with wages, Bristol is becoming more unaffordable for first-time buyers.

MOST READ IN MONEY

Owen Woodley, managing director, Post Office Money, said: "With average house price growth having increased by 48 per cent since 2005, compared with an increase to the average first-time buyer income of only 37 per cent over the same period, there is no question that the UK housing market remains a challenging environment for many.

"In spite of this we're seeing that first-time buyers approach the market with enthusiasm and flexibility."

First-time buyer motivations

The drive to buy is alive and well with the biggest emotional drivers cited for deciding to buy a house being:

- having met a partner and wanting to make a home together (24 per cent)

- wanting the security of a long-term place to live (21 per cent)

- wanting to move out of a parent’s/family’s property (16 per cent)

- feeling it was expected that they should own a home (15 per cent)

First-time buyers have been forced to consider new ways of getting onto the property ladder in recent years, with nearly one in four of them say it took them between five and ten years to save up enough for a house deposit.

Buyers now need an average of almost £33,000 to buy a home - and Londoners need to stump up even more needing an average of £106,577 to get on the property ladder.

A report by Halifax’s First-Time Buyer Review, released last month, revealed the average first-time deposit has doubled over the last decade, while London prices have quadrupled during the same time.

Nearly half of first-time buyers now rely on cash from their parents to help them become homeowners - an alarming trend in Britain’s spiralling housing crisis.

Tips for first-time buyers

- Identify the more affordable areas of the city or region you want to move to, by looking where property prices are much lower than the city or region's average.

- Consider avoiding areas that have experienced particularly high house price growth in recent years, as that may suggest potential for future growth has been already exhausted and prices will not grow much going forward.

- Look into whether there are any transformation projects or infrastructural developments planned. These could signal a potential increase in house prices.

- Look at the crime rates in the area to understand the severity of the crime and whether the picture is improving or worsening.

- Find out if there are any developments planned for schools in the local areas. Improvement in the education offering in affordable areas can push house prices up.

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516