Logbook loan lender MobileMoney makes MASSIVE blunder after it emails borrower with another customer’s details

Customers of logbook loan lender MobileMoney pay a massive 189.9 per cent interest on their borrowing

A LOGBOOK loan borrower has spoken of his horror after the firm sent him personal details of ANOTHER customer.

Stephen Middleton, 32, said he was "shocked" at how irresponsible lender MobileMoney had been after a staff member emailed a fellow customer's name, and workplace address and phone number to him by mistake.

Gas engineer Stephen said: "I don't know how they could be so stupid, I couldn't believe it.

"I was shocked by how inconsiderate they could be with someone's details.

"Surely they have a duty of care to look after customer data?

"He's probably a customer just like me."

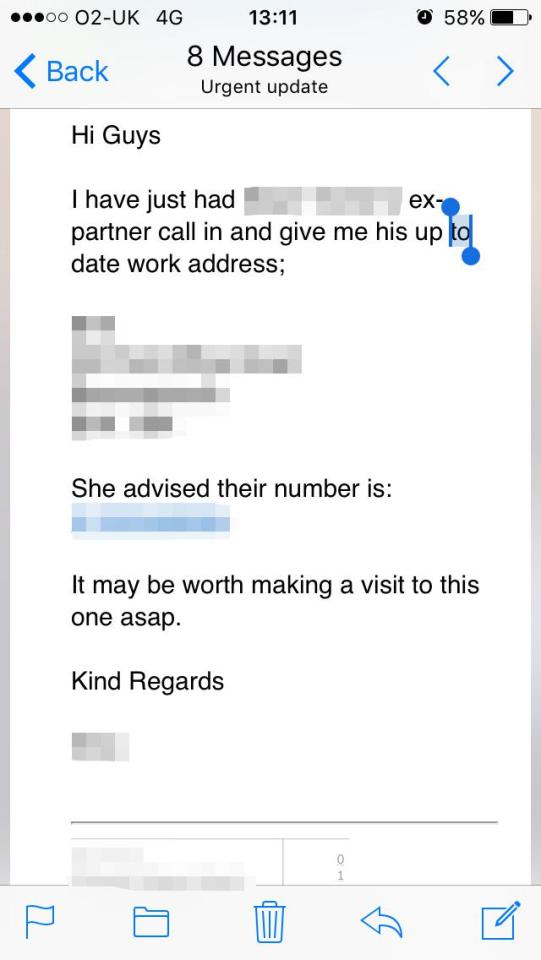

The email, seen by The Sun Online, says the customer's ex-partner has "just called in" and has given his work address and phone number.

"It may be worth making a visit to this one asap," the customer service agent adds.

On its website MobileMoney says it is the UK's first "logbook lender" having been set-up in 1998.

Logbook loans are loans secured against a borrower's vehicle.

Customers can lend between £500 and £25,000 at an APR rate of up to 189.9 per cent.

That means a borrowing taking out a £1,000 loan over 18 months will end up paying back £2,094.

While a customer who took out a loan with a leading bank for the same of money over the same amount of time would pay £1,106 - at a rate of 13.9 per cent.

Mr Middleton said he took a £1,000 loan in April in order to pay for repairs to his van which he needs for work but has recently been struggling to meet the repayments of £135 a month.

In total he says he'll payback more than £2,000.

"It was far too easy to get one to be honest," he said.

"I went on the website and put in my car registration and employment status and they rang me straight back."

IDENTITY CRISIS Equifax admits up to 400,000 Brits' information was exposed in MAJOR data breach

Following the first email, the staff member wrote back apologising for the error.

"It was supposed to go to similar contact name to yourself," she added.

In another email the staff member wrote: "I apologise again, it was simply one key I typed on the keyboard incorrectly.

"There was no intention whatsoever to send this email to yourself."

The member of staff added the firm was going to help Mr Middleton with his "financial situation."

The Sun Online contacted the body which deals with potential data protection breaches, the Information Commissioner's Office (ICO).

It told us that while it was unable to comment on specific cases, business are "obliged" under law to keep people's information safe and secure.

"If someone thinks their personal details have not been kept secure, they can raise it with us," the spokeswoman added.

The Sun Online asked MobileMoney how this could have happened but it hasn't replied to our request for comment.

What are logbook loans?

YOU'VE probably heard of payday loans but what is a logbook loan?

It's a loan secured against your car, van or vehicle.

You can still use the vehicle but technically the lender is the car's legal owner until you've repaid the loan.

This means if you fall behind on your payments you can have it repossessed.

The amount you can borrow depends on the value of your vehicle though some firms will lend up to half your car's value.

The Money Advice Service says that these types of loans are "risky and expensive" and should be avoided.

More on money

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516