House prices in London fall for the first time in eight years

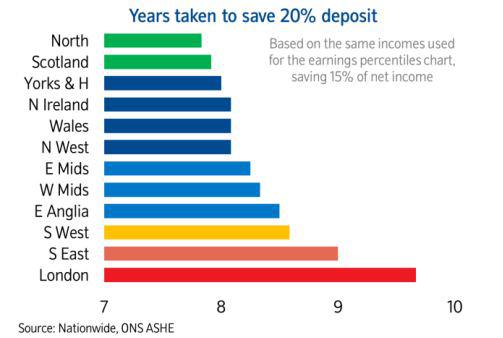

Nationwide calculated that across the UK would-be buyers face around eight years saving for a deposit

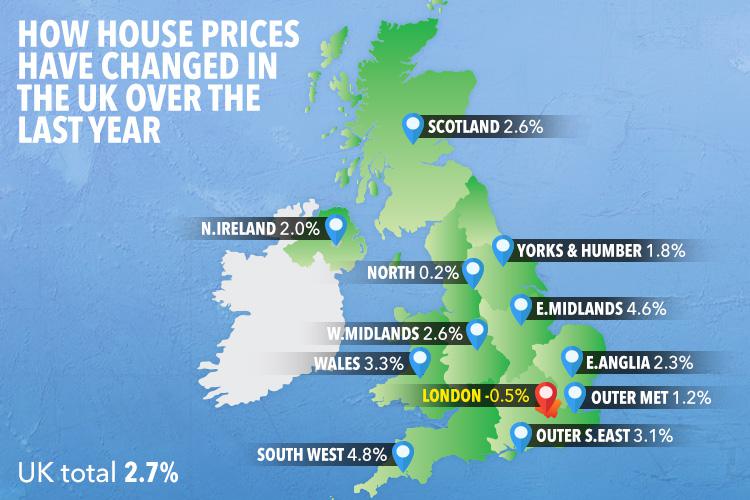

LONDON as the only region in the UK to experience a drop in house prices last year, according to new data.

It's the first time since 2004 that the capital has been identified as the weakest-performing region, according to Nationwide Building Society.

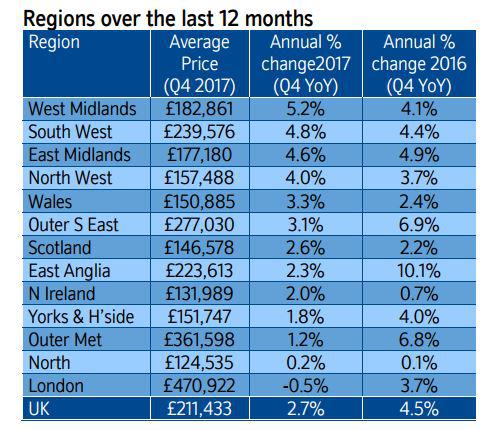

It's not all bad news though. Average prices across the UK hit £211,156 in December, making a 0.6 per cent month-on-month increase and an annual 2.6 per cent rise.

The yearly increase is the slowest since 2012 and it compared with a 4.5 per cent annual increase last year.

For the first year since 2008, prices in northern England and the Midlands combined grew at a faster rate than in southern England, Nationwide said, with a 3.6 per cent year-on-year increase compared with 1.6 per cent.

In London, prices were down 0.5 per cent annually, taking the average to £470,922.

The strongest-performing region was the West Midlands, with prices up by 5.2 per cent annually, followed by the South West at 4.8 per cent.

An increase of 3.3 per cent was seen in Wales, with 2.6 per cent in Scotland and 2 per cent in Northern Ireland.

Robert Gardner, Nationwide's chief economist, said 2017 "saw the beginnings of a shift", as rates of price growth in the South moderated towards those in the rest of the country.

He said: "London saw a particularly marked slowdown, with prices falling in annual terms for the first time in eight years, albeit by a modest 0.5 per cent.

"London ended the year the weakest-performing region for the first time since 2004."

Mr Gardner said a 20 per cent deposit in London now typically equates to more than £80,000, based on the average first-time buyer price. This is around £30,000 higher than a decade ago.

In other regions, such as the Midlands and northern England, deposit requirements are similar to 2007, he said.

Nationwide calculated that would-be buyers face spending around eight years saving for a deposit, rising to nine years in the South East and nearly 10 years in London.

Mr Gardner said subdued economic activity and an ongoing squeeze on household budgets is likely to exert a modest drag on housing market activity and price growth in 2018.

PROPERTY LADDER What will happen to house prices in 2018? Experts share their views

He said: "Overall, we expect house prices to record a marginal gain of around 1 per cent in 2018.

"Over the longer term, once the economy regains momentum, we expect house prices to rise broadly in line with earnings."

Mr Gardner said much will depend on how Brexit impacts on the UK economy.

MORE ON HOUSE PRICES

In a separate study, house prices in England rose by almost £10,000 last year, according to Zoopla.

While a small market town in Sulfolk, Bristol and a town in Scotland were all tipped as the property hotspots of 2017.

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516