Tenants outside London now spend over HALF of their disposable income on rent

Take home pay is being eaten away by rent as prices soar by 7 per cent in the last five years

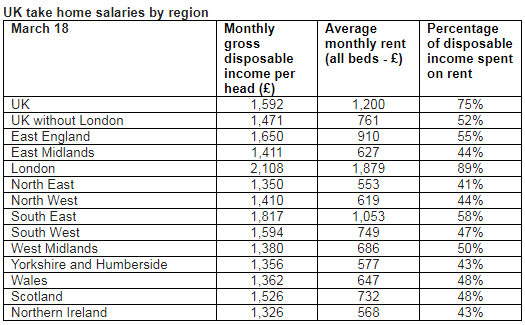

BRITS renting outside of London now spend more than half of their disposable income on rent.

The average rent in the UK now stands at £761 a month, with those in London forking out an eye-watering £1,879 for a place to live.

On average UK renters outside of London spend 52 per cent of their take-home-pay on rent.

Outside the capital UK tenants have on average £1,471 a month left over after bills and expenses.

That means that renters are spending £9,132 of their disposable income on rent every year.

With rent prices rising by 63 per cent in the last ten years, house prices inflating and continued low interest rates, it is becoming harder and harder for anyone to put away enough cash to get on the property market.

But, it gets a lot worse if you are renting in London.

Londoners can expect to spend £1,879 a month on rent, just over 90 per cent of the average disposable income for London.

But if Londoners are willing to move just a little bit more south they could save themselves a bundle.

Those living in the South East pay just 58 per cent of their take-home-pay on rent, which comes out at an average of £1,053 a month.

How to haggle with your landlord and bring down your rent

When you first sign your tenancy agreement with your landlord your rent should be agreed either in writing or verbally.

To increase your rent your landlord must send you a section 13 notice which gives you a month's notice in writing telling you how much your rent will be increased by and the date when your rent will go up.

At this stage you should try to talk to your landlord and come to a fair agreement on how much rent you should pay.

Your landlord can only raise your rent if you agree to the increased price.

Matt Hutchinson, communications director for flatsharing website SpareRoom.com said that if you are a good tenant then you've got bargaining power.

"The first thing to bear in mind is that demand is lower at the moment than over the past couple of years.

"That means you’ve got a bit more bargaining power, especially if you’ve been a good tenant, as your landlord won’t want the expense and hassle of having to find another tenant and even potentially face a period with the property empty.

"Failing that, it’s worth seeing if you can get anything thrown in with a rent increase, such as minor bits of redecorating or any bills."

Landbay have a free rent check service to see how much rent you should be paying in your area.

You can find the rent check service

Find out more about how to haggle with your landlord to bring your rent down here.

Although wages are due to rise by 3.1 per cent this year, we are still recovering from pay being behind inflation last year.

In 2017 inflation increased by 2.6 per cent whilst pay lagged behind with an increase of 2.1 per cent.

Combined with one in five tenants facing an increase in rent this year, as well as house prices rising by 0.6 per cent in February.

It has certainly been a hard time to rent or save for a home.

The cheapest average rent in the UK is found in the North East, where renters only pay £551 a month.

Even though the region has the lowest salaries and the lowest disposable income in the country.

Take-home-pay in the North East is just £1,350, but renters only spend 41 per cent of their spare cash on paying the rent.

Those in Northern Ireland and Yorkshire and Humberside also have it a bit easier with only 43 per cent, or £568 and £577 respectively, of their disposable income being spent on rent.

John Goodall, CEO and founder of Landbay said: "Rents have continued to rise over the last five years, increasing by 9 per cent across the UK since March 2013 and by 7 per cent in London – with monthly payments remaining a burden on those struggling to save.

"Tenants saving up for a house face a triple challenge with more and more of their income spent on rent, partnered with trying to catch up with the pace of house price inflation and record low interest rates limiting their ability to save money."

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516. Don't forget to join the for the latest bargains and money-saving advice.