New Experian tool reveals whether you’ll get accepted for a mortgage and how much you can borrow

BUYING a home is a huge financial investment that comes with a lot of stress, especially if it's your first time - but a new online tool hopes to make it easier.

Experian has launched a new eligibility tool to help buyers find out which mortgages they might be accepted for and how much they could borrow.

How does it work?

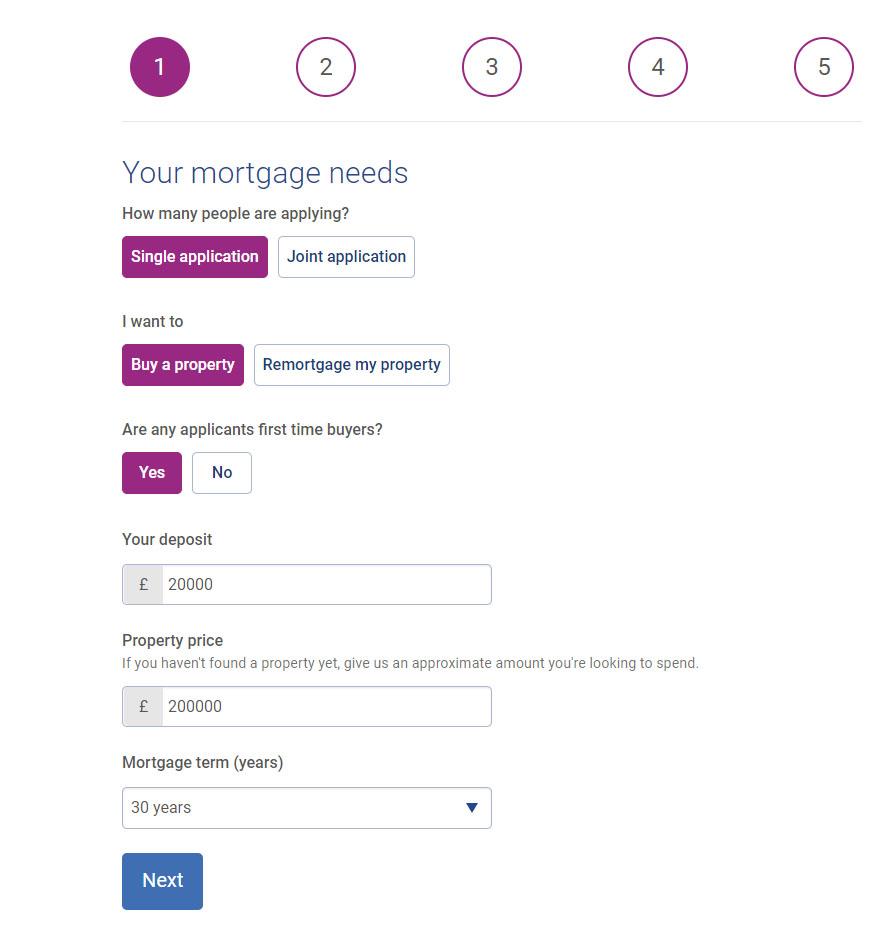

The tool is on and requires you to have a free account so it can calculate your chance of approval.

It was first trialled last year for 50 per cent of its users, but it is now available for everyone.

The tool claims to help you compare mortgages without harming your credit rating.

Experian says it will take you about 10 to 15 minutes to find out what you might be accepted for and how much you could borrow.

First, you have to enter in some personal details, including the size of your deposit, if you're putting in a single or joint application, the price of property you're looking at, the size of your debts, and your annual income.

It'll then flag what mortgages you are likely to be accepted for and say if you've got a "good" or "excellent" chance of getting the deal.

It will also show you how much extra you'll need if your deposit is too small.

Helpfully, it will carry out a "soft-search" on your credit file, meaning your credit score won't be impacted if you try the service.

The new service could be real help, especially for first-time buyers who may be confused by the world of mortgages.

A quarter of homeowners describe the mortgage process as the biggest challenge when it comes to buying a house rather than securing a deposit, according to new research by Experian.

How to boost your chances of being approved for a mortgage

There are several ways you can increase your chance of being approved for a mortgage and getting your first step on the ladder, according to Experian.

Work out your budget: Work out how much you can realistically afford keeping in mind how much your mortgage repayments will be. As well as the deposit also consider other associated costs including stamp duty, solicitor and surveyor fees.

Put a deposit together: Put together the largest deposit you can - the larger your deposit, the better the deal.

Get your credit report in shape: Make sure your credit report is accurate, up-to-date and in the best position possible. You can check your with an Experian account to give you an idea of where you stand.

Prepare well before applying for a mortgage: This may seem like an obvious tip but take extra care when filling in application forms, the smallest of errors can cause huge delays and in some cases the whole application may have to be submitted again.

Mortgage lenders will want to know your outgoings which also includes your utility bills and other fixed regular costs eg school fees, phone contracts, and Netflix/Spotify subscriptions.

But only seven lenders have signed up to the tool so far: Barclays, West Brom, Aldermore, Family Building Society, Leeds Building Society, Co-op, and Coventry.

It limits your choice, and means you might get accepted for a mortgage elsewhere even if the tool doesn't give you any mortgage options.

Experian said it expects to sign up more lenders in the next few months.

There are other mortgage eligibility tools available. offers eight calculators to help you find out how much you could borrow and which mortgages are right for you.

The also has a mortgage affordability calculator that estimates how much you could borrow.

The credit reference agency has also created a new , which aims to help buyers understand more about the house-buying journey.

Amir Goshtai, managing director of Experian Marketplace & Affinity said: “We have become used to checking our eligibility for products like credit cards and loans for some time now, and there’s no reason the service shouldn’t be available in the mortgage market too.

“Making sure consumers are well informed about their options will give them confidence when speaking to a mortgage broker.

"Experian’s eligibility tool provides straightforward answers allowing buyers to feel prepared without affecting their credit score.”

Most read in Money

Applying for a mortgage can be a daunting process, so The Sun has put together a guide showing you how to apply and boost your chances of being approved.

We've also revealed how to find the best mortgage if you're a first-time buyer - and how all you'll need is a 5 per cent deposit.

Last month, we shared the banks that you can get a mortgage from without having to show them your bank statements.

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516. Don't forget to join the for the latest bargains and money-saving advice.