Santander is making a big change to payments to help stop payment scams

From today, Santander customers setting up a new payment online will be asked why they're making the transaction

SANTANDER customers will now be asked a series of questions before transferring money online in a bid by the bank to prevent payment fraud.

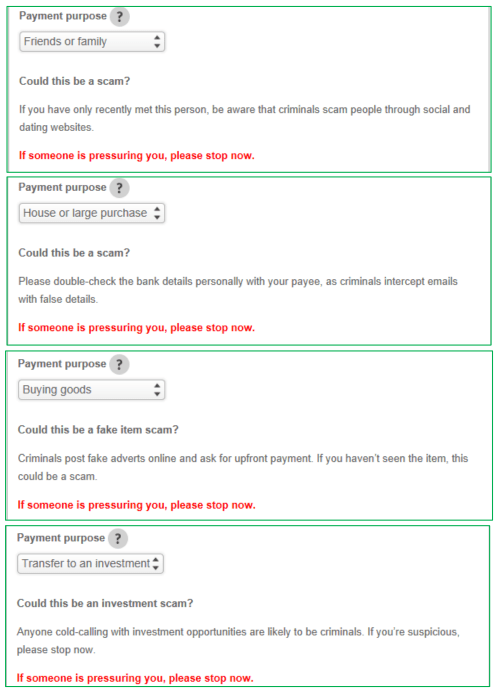

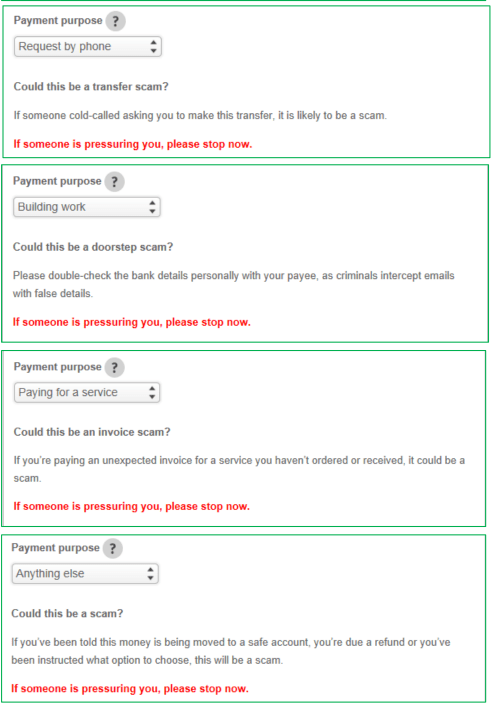

From today, people setting up a new payment will be asked why they're making the transaction.

They can pick from options including family and friends, house or large purchase, building work, and transfer to investment.

Depending on the selection the customer makes, information about avoiding related scams will then be provided.

This step will also be introduced to branches and telephone banking services over the coming weeks.

It comes after new figures today revealed that £145.4million was lost to fraud in the first six months of the year.

Sadly, victims of this type of fraud have little option for redress and banks often push the blame onto customers.

Santander believes it is the only bank to ask customers these specific questions each time they make a payment.

The bank says the questions are based on research and data around the frauds that its customers are targeted with.

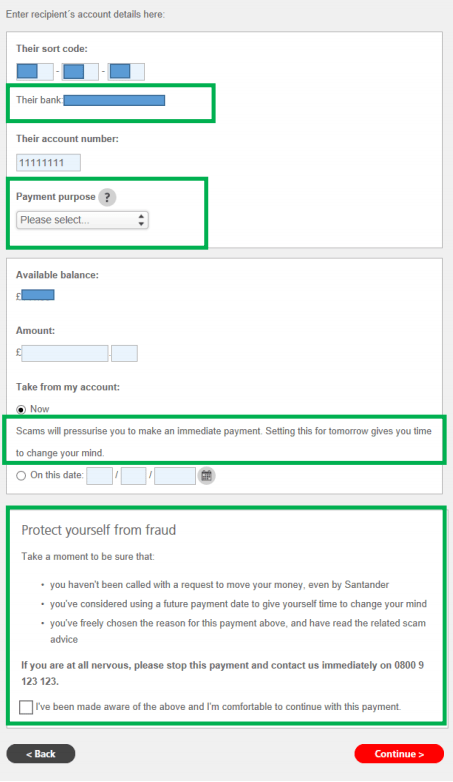

Santander will also advise customers that setting the payment to be transferred at a later time or date gives users time to change their mind and cancel the payment if necessary.

In addition, customers will be asked to confirm they are not being asked to move their money, that they have freely chosen the reason for the payment, and have read the bank's scam warning before they continue.

When customers make a payment, the recipient bank’s name will also now be displayed based on the sort code provided so customers can see clearly which bank and branch their payment is going to.

How do I protect myself from fraudsters?

To stay safe, UK Finance urges people to follow its advice:

- A genuine bank or organisation will never contact you out of the blue to ask for your PIN, full password or to move money to another account.

- Only give out your personal or financial details to use a service that you have given your consent to, that you trust and that you are expecting to be contacted by.

- Don’t be tricked into giving a fraudster access to your personal or financial details.

- Never automatically click on a link in an unexpected email or text.

- Always question uninvited approaches in case it’s a scam. Instead, contact the company directly using a known email or phone number.

Chris Ainsley, head of fraud strategy at Santander said: “We are pleased to be introducing these changes which we believe offer a new and unique approach to preventing payment scams, and, crucially, providing better protection and awareness for our customers.

“In the light of recent industry figures on APP scams, it is clear that nobody can afford to be complacent when it comes to scams.

"We are absolutely committed to fighting fraud and are actively developing other ways in which we can put a stop to the criminals who ruin people’s lives.”

More on scams

Earlier this year, banks were slammed by the Financial Ombudsman Service for blaming customers who’ve been scammed – your rights if you’ve been conned.

Which? research shows that 80 per cent of people think that banks should be responsible for recouping money lost to bank transfer scams.

We pay for your stories! Do you have a story for The Sun Online news team? Email us at tips@the-sun.co.uk or call 0207 782 4368. You can WhatsApp us on 07810 791 502. We pay for videos too. Click here to upload yours.