First-time buyers need a £53k salary to afford a home in UK’s biggest cities

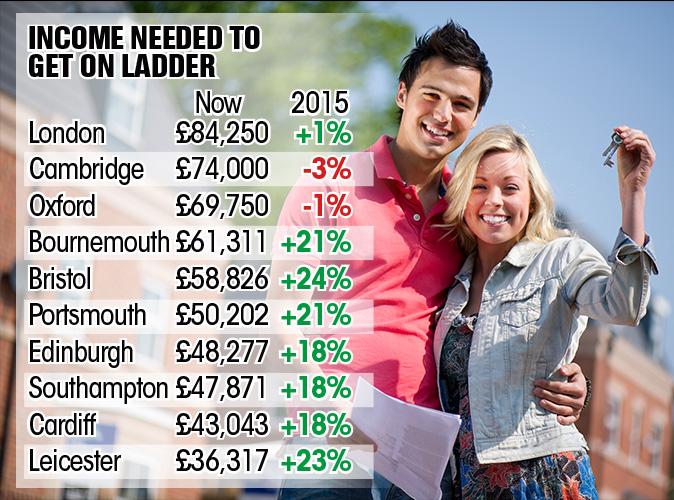

FIRST-time buyers need an income of at least £53,000 for a home in Britain’s 20 biggest cities, a study has found.

The sum is up by £8,000 — 18 per cent — in three years due to sharp house price growth.

In London, they need an average income of £84,250. But that amount has risen only one per cent since 2015 due to market stagnation.

Buyers in Manchester or Bristol need an income 24 per cent higher than three years ago, said analysts Hometrack. It shows how quickly property prices have outstripped wage growth.

In Birmingham, Nottingham and Leicester buyers now need 23 per cent more.

In pricey Cambridge the earnings needed have fallen by three per cent but still stand at £74,000.

The figures assumed buyers would take out a repayment mortgage over 30 years, would not borrow more than four times their salary and would spend up to 30 per cent of gross income on mortgage costs.

Hometrack also used average mortgage interest rates and the size of deposits put down by first-time buyers.

What help is out there for first-time buyers?

GETTING on the property ladder can feel like a daunting task but there are schemes out there to help first-time buyers own their own home.

Help to Buy Isa - It's a tax-free savings account where for every £200 you save, the government will add an extra £50. But there's a maximum limit of £3,000 which is paid to your solicitor when you move.

Help to Buy equity loan - The government will lend you up to 20 per cent of the home's value - or 40 per cent in London - after you've put down a five per cent deposit. The loan is on top of a normal mortgage but it can only be used to buy a new build property.

Lifetime Isa - This is another government scheme that gives anyone aged 18 to 39 the chance to save tax-free and get a bonus of up to £32,000 towards their first home. You can save up to £4,000 a year and the government will add 25 per cent on top.

Shared ownership - Co-owning with a housing association means you can buy a part of the property and pay rent on the remaining amount. You can buy anything from 25 to 75 per cent of the property but you're restricted to specific ones.

"First dibs" in London - London Mayor Sadiq Khan is working on a scheme that will restrict sales of all new-build homes in the capital up to £350,000 to UK buyers for three months before any overseas marketing can take place.

Starter Home Initiative - A government scheme that will see 200,000 new-build homes in England sold to first-time buyers with a 20 per cent discount by 2020. To receive updates on the progress of these homes you can register your interest on the website.

Richard Donnell of Hometrack said: “Cities like London and Cambridge require the highest incomes to buy a home and as a result they are registering flat, to falling, prices.

“Meanwhile, cities like Bristol and Bournemouth are starting to register slower growth as affordability pressures increase.

“Higher prices and a further drift upwards in mortgage rates means that these affordability pressures will continue to steadily build.”

MOST READ IN UK NEWS

There are a handful of schemes designed to help get first-time buyers on the property ladder, including the government's Help To Buy policy.

But 4,500 first-time buyers are actually getting into debt due to a catch with the Isa which means the government's top up can't be maximised.

One Brit couple Ryan and Kiera Crabbe have moved 800 miles from London to Spain to help save up for a deposit on a one-bed flat because it is cheaper than renting in the capital.

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516. Don't forget to join the for the latest bargains and money-saving advice.