How to clear your debt by Jan 31 in 9 easy steps

The average Brit will have a Christmas hangover of £740 of debt and £323 on credit

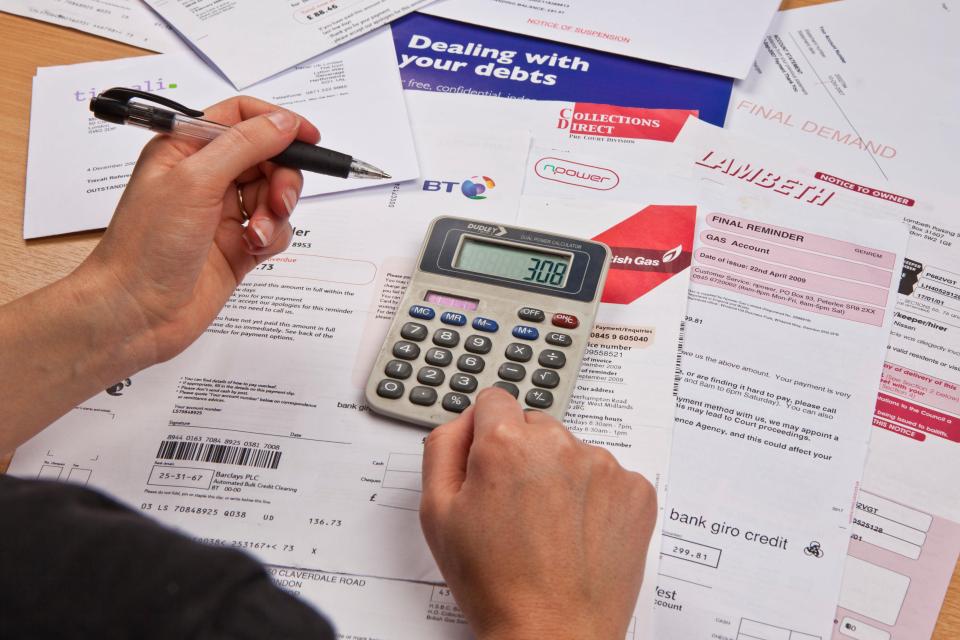

CHRISTMAS can leave families in trouble with big debts to pay off - but there are ways to clear what you owe within the month if you follow nine easy steps.

The average Brit will have a Christmas hangover of £740 of debt and £323 on credit, according to research by MoneySuperMarket.

If you've been left in financial dire straits because you've overspent this Christmas, don't panic.

Finance experts have shared their top tips with The Sun to reveal how you can keep lenders at bay and pay off as much as you can afford by January 31.

These are the top 10 tips to follow if you find yourself in debt this January.

Dennis Hussey, money adviser at said: "During the festive season people can feel pressured to spend more money which can cause worry and affect people’s finances at the start of a new year.

"If you are worried about money, don’t wait to take action.

Don't ignore your bills - and make a list of your debts

They say knowing is half the battle, and that's also true when it comes to clearing your debt.

The first step in successfully paying off what you owe is to find out what your debts are.

Make a list of who you owe money to and how much, and add up how much you need to pay off in total.

Don't ignore the bills that come through your letterbox, even if it's tempting, as burying your head in the sand will just make the problems worse.

Lorraine Charlton, debt expert at , suggests contacting your lenders to find out what you owe if you don't have your most recent statements.

How to cut the cost of your debt

Being in a large amount of debt can be really worrying. Here are some tips from Citizens Advice on how you can take action.

Check your bank balance on a regular basis - knowing your spending patterns is the first step to managing your money

Work out your budget - by writing down your income and taking away your essential bills such as food and transport.

If you have money left over, plan in advance what else you’ll spend or save. If you don’t, look at ways to cut your costs

Pay off more than the minimum - If you’ve got credit card debts aim to pay off more than the minimum amount on your credit card each month to bring down your bill quicker

Pay your most expensive credit card sooner - If you have more than one credit card and can’t pay them off in full each month, prioritise the most expensive card (the one with the highest interest rate)

Prioritise your debts - If you’ve got several debts and you can’t afford to pay them all it’s important to prioritise them.

Your rent, mortgage, council tax and energy bills should be paid first because the consequences can be more serious if you don't pay.

Get advice - If you’re struggling to pay your debts month after month it’s important you get advice as soon as possible, before they build up even further.

Groups like Citizens Advice and National Debtline can help you prioritise and negotiate with your creditors to offer you more affordable repayment plans

Make a budget and prioritise your debts

Debt experts say the most important step in clearing what you owe is to make a budget so you can get on top of your finances.

Prepare a monthly plan of what you will spend on everything, from household bills to the weekly food shop.

Don't forget to factor in annual expenses such as car insurance and road tax. You can work out how much you need to pay off by dividing the annual sum in 12, according to Mr Hussey.

that can help you work out what you can afford.

The charity network urges people to pay off their "priority debts" first, which includes your rent or mortgage, energy bills, and council tax.

These need to be paid off first as they could leave you homeless or in court, Citizens Advice warns.

StepChange's Mr Shaw adds that you need to make sure you cover the minimum payment on every debt as you have to avoid default charges that will affect your credit rating.

After that, it suggests paying most towards the highest-cost borrowing - the debt on which you’ll have to pay most interest and charges.

Make some extra cash

If your normal income won't cover your Christmas debts, then it may be worth looking at extra ways you can make a bit of cash.

Andy Shaw, debt advice co-ordinator of debt charity , suggests selling unwanted Christmas presents on eBay, using cashback websites when shopping, and taking on a few extra hours at work.

Francesca Mason, 29, who writes about finance on her blog and cleared thousands of pounds worth of debt, also says it's worth picking up a second job such as waitressing or bartending.

She said: "This only needs to be a temporary thing until your debt is paid off, and it will speed up the time of doing this massively."

She also suggests setting up a "side hustle" to make some money in addition to your job, such as mystery shopping, selling homemade crafts, blogging, dog walking and cat sitting.

StepChange has on the side.

Slash your household bills and make savings

You could be paying much more than you need to for many of your household bills, according to Mr Hussey.

He said: "Take some time to look at what you are paying and whether you could get a better deal."

You can use price comparison websites such as , and .

There are also auto-switching services, which do the hard work for you and switch you onto a better deal by comparing thousands of tariffs.

By switching energy suppliers, you could save £300 a year.

You can also tighten your belt and make some savings.

Mr Shaw, of StepChange, said: "It can be as simple as switching to a cheaper supermarket, or taking shorter journeys on foot rather than by car or bus."

Check if you're entitled to extra cash

Millions of pounds worth of benefits and tax credits are unclaimed every year, so make sure you're not missing out on cash you're entitled to.

It's easy to check if you can get some extra help.

Poverty charity Turn2Us has that will do all the work for you.

The Government also recommends calculators from and .

Mr Hussey, of National Debtline, said: "It can make a real difference to your finances."

Speak to your creditors

If you're struggling to afford your debts, don't ignore them.

First, sort them into priority and less-urgent debts.

If you have multiple priority debts that you can't pay, Citizens Advice says that you should contact your creditors to find if you can negotiate on how much you pay or when you pay them.

For less urgent debts, you could contact your lenders and offer them what you can afford to pay.

Ms Charlton, of Citizens Advice, warned: "Always pay first priority creditors who are taking action against you."

How to get help for free

There are lots of groups who can help you with your problem debts.

- Citizens Advice - 0808 800 9060

- StepChange - 0800 138 1111

- National Debtline - 0808 808 4000

You can also find information about Debt Management Plans (DMP) and Individual Voluntary Arrangements (IVA) on the and on the Government's

Speak to one of these organisations - don't be tempted to use a claims managment firm that will claim it can write-off lots of your debts in return for a large up-front fee.

Make a free debt management plan

Managing your debts can be overwhelming, but there are ways to make it easier.

If you have any money left after paying priority debts, Citizen's Advice said you could consider getting a free debt-management plan for your non-urgent payments.

The debt management provider will deal with your creditors and you will just make one monthly payment of what you owe to the provider.

provides a free debt management plan service.

Avoid claims management services who will charge you a large upfront fee.

Get a zero balance transfer card

If you have debts with a high interest rate, there are ways to cut that interest down by getting a 0 per cent balance transfer card.

These cards will let you transfer an existing balance to a new card and gives you the chance to clear it fully without incurring any interest.

Francesca Mason, of From Pennies To Pounds, said she used zero per cent balance transfer cards when she cleared her debt.

She spiralled into thousands of pounds worth of debt when she became a single mum but has since paid it all off and started a money-saving blog to help other parents do the same.

She warns that zero per cent balance transfer cards will only have a low rate for a limited amount of time before the interest climbs up.

What you need to know about balance transfer cards

SHIFTING your balance can be a great way to cut the cost of your debt. But you must use them properly so you don't just add to it.

Always clear your debt - Credit card firms don't offer these deals out of the goodness of their hearts. They rely on you not clearing your balance by the time the 0 per cent deal comes to an end so it can start charging you interest.

Always make your payments - If you don't keep up with your monthly payments, you could lose the 0 per cent offer and start being charged interest. Always try and pay-off more than the minimum payment too to clear your debt quicker and don't spend on the card either.

Check your deal - Like with all credit cards, you might not be offered the headline deal if you don't have the best credit history. Use to see what deals you are likely to be accepted for.

She said: "You need to be 100 per cent sure that you will be able to pay it off before the interest goes up, but this is a great way of saving money, as you won’t be paying the interest.

"I personally did this when I paid off my debt, and having the deadline of the 0 per cent interest ending really helped to motivate me as well."

will let you know what deals you will likely qualify for.

The MBNA Low Rate card has the longest 0 per cent deal on the market currently at 48 months (four years) but only people with decent credit scores are likely to get accepted for that long a deal.

When you apply, you could be accepted by the provider but be offered a smaller 0 per cent period.

Remember to always try and clear your balance before the period ends - lenders rely on you failing to do this so they can start charging you interest.

Ask for (free) advice

The most important thing is to remember that you are not alone in having debt left over from Christmas.

There is plenty of free, independent advice available from charities including National Debtline, Citizens Advice, Turn2Us, and StepChange.

StepChange says that 50 per cent of its clients wait a year before seeking help.

But as Mr Hussey, of National Debtline, explains: "The earlier you seek free advice, the quicker and easier your problem will be to solve."

More on Money

In a victory for The Sun, there has been a crackdown on doorstep loan companies, store card and catalogue debt.

MoneySavingExpert has just launched a new tool to help you reclaim hundreds of pounds for mis-sold payday loans.

In August, we revealed how payday loan customers could be due millions back in compensation.

We pay for your stories! Do you have a story for The Sun Online Money team? Email us at money@the-sun.co.uk or call 0207 78 24516. Don't forget to join the for the latest bargains and money-saving advice.