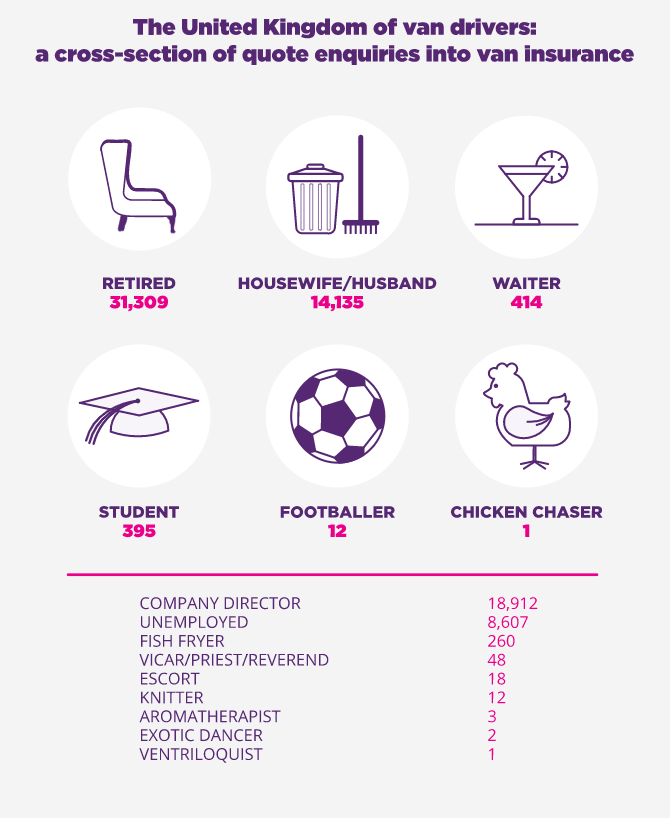

Vicars, strippers and professional knitters – the changing face of Britain’s van drivers revealed, as well as who crashes them the most

Van ownership is on the up, and not just for manual labour jobs either, as new research unveils who's really behind the wheel

THE WHITE van man stereotype may soon come to an end, as new research shows that owners are more eclectic than ever.

But with a change of van users on the road - which ones are now responsible for their bad reputation?

A third of van owners are female according to research by , with 40 per cent of all drivers using their van for non-business purposes.

Over 31,000 owners are retired, with housewives and husbands making up more than 14,000 of van insurance quotes on .

Meanwhile, 48 vicars/priests/reverends, 18 escorts and a chicken chaser have also enquired about van cover on the site.

When put in proportion, property developers are the most likely to have a pre-existing accident claim in vans - with one in 4.2 having done so.

However, it's plumbers and heating engineers that actually lodge the most claims - again, when careers are put in proportion.

One in nine claim after an accident they have caused, while company directors are the second most accident-prone. One in 11 claims are by a carpenter and one in 12 are joiners.

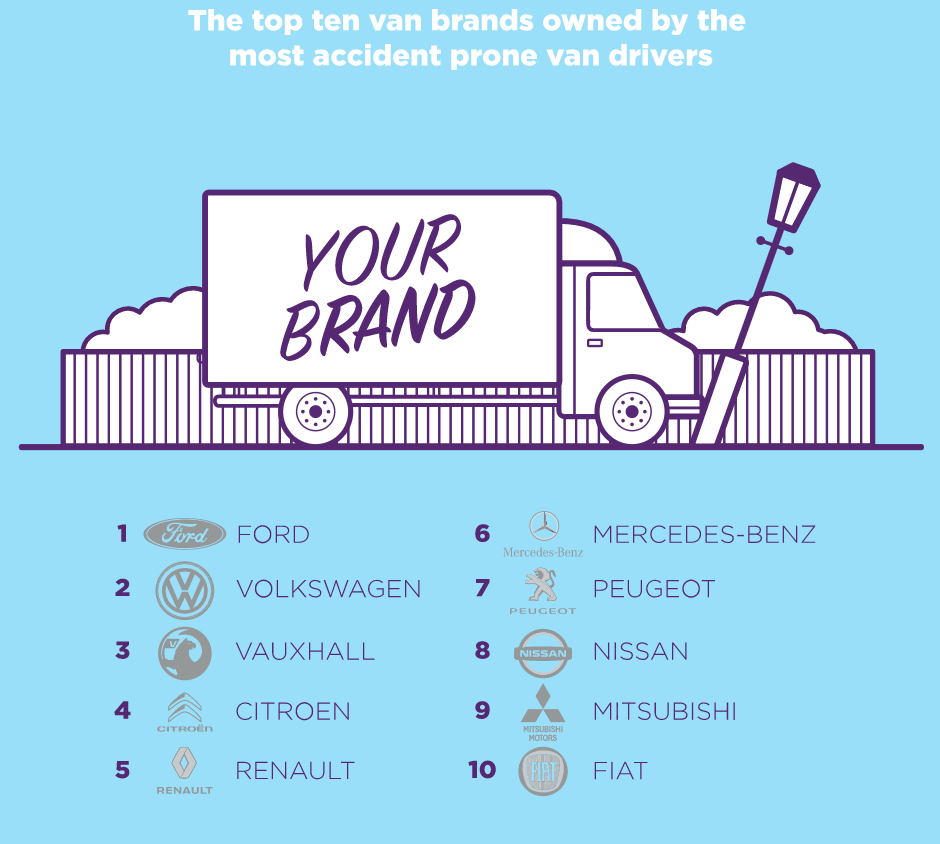

Fords are involved in the most van accidents, with a 27-per-cent rate when put in proportion with the number of other manufacturers on the road.

Vauxhalls make up 17 per cent and Volkswagens account for just over one in 10 van crashes.

The most common accident with a van driver at fault was the 22 per cent who went into the back of another vehicle.

Hitting a parked car made up 18-per-cent of the claims, while 15 per cent ran into the back of an object such as a lamppost or wall.

MORE FROM MOTORS

Every month, over 8,300 people are redirected from searching for a car insurance quote to van cover after they type in their car registration plate, suggesting that many aren't aware that you specifically need a van policy.

Tom Flack, MoneySuperMarket Editor-in-Chief, said: "The number of vans on the roads has grown by more than 100,000 over the past five years, but many drivers are unaware that you need a separate van policy - even if you already have existing car insurance.

"This is particularly important if the vehicle is used for commercial purposes, which you must state in the policy. Failing to do so can actually make any claim void in the event of an accident.

"When looking for a van insurance policy, do your research and shop around - there are substantial savings that can be made by comparing quotes and finding a deal that works for you."