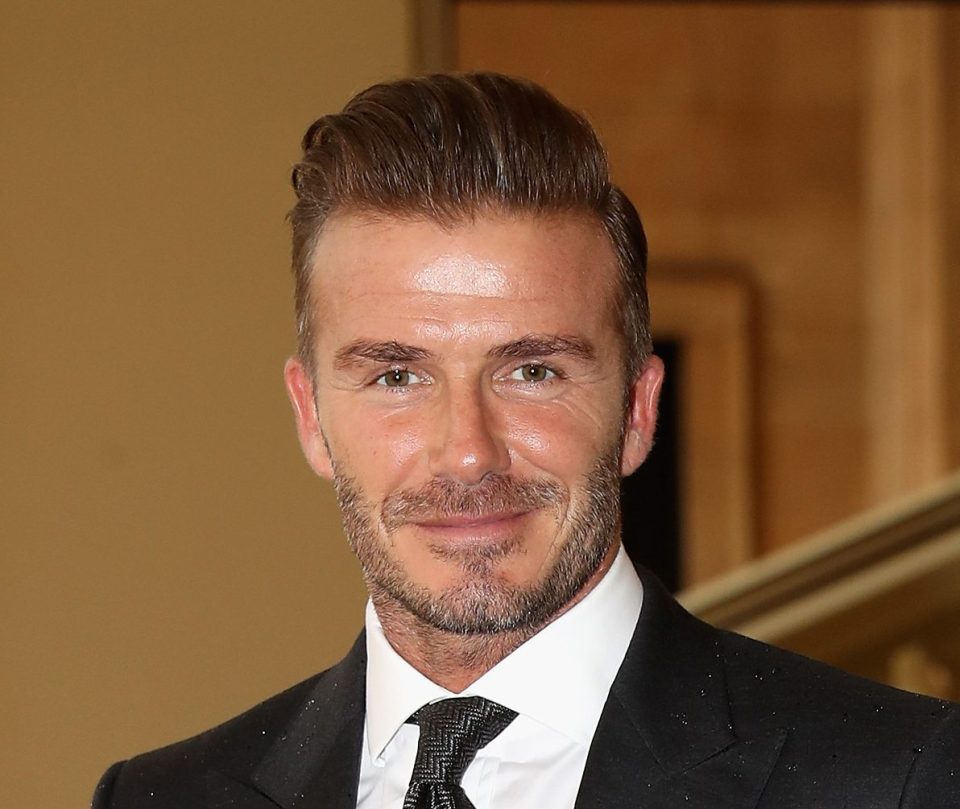

England heroes Wayne Rooney and David Beckham among stars hit by a £700million tax bill from a film investment scheme

Gary Lineker and Match of the Day colleagues Martin Keown and Danny Mill also faced bills of £4.5million

A HOST of celebs are being forced to pay back cash they saved from a film scheme as part of a £700million tax bill.

Wayne Rooney and ex-England heroes David Beckham and Gary Lineker joined hundreds of others in investing.

Lineker’s Match of the Day colleagues Martin Keown and Danny Murphy have had bills for £4.5million, it is understood.

They were among big names including comic Sacha Baron Cohen to pay into the Ingenious Media scheme. It used bogus losses from investing in films, including Avatar and Life of Pi, to offer tax relief.

HM Revenue & Customs has won a tribunal fight to reclaim £700million of the tax relief paid to the investors.

Officials at HMRC said it also expected to claim "big" interest payments after investors enjoyed access to hundreds of millions of pounds for about a decade.

Related stories

Tax expert Michael Avient, a partner at UHY Hacker Young which represented investors, said many footballers being forced to pay back the huge sums were now retired and could end up in "very dire straits".

Martin Smith of Ingenious Media said the ruling was “disappointing”. He said the firm may appeal.

Jennie Granger of HMRC added: “If something seems too good to be true, then it probably is.”