Business tycoon Sir Philip Green would face a £1billion bill for the BHS pension scandal under ‘nuclear’ proposals from MPs

New proposals from MPs say the Pensions Regulator should be given powers to clobber entrepreneurs to help plug fund gaps

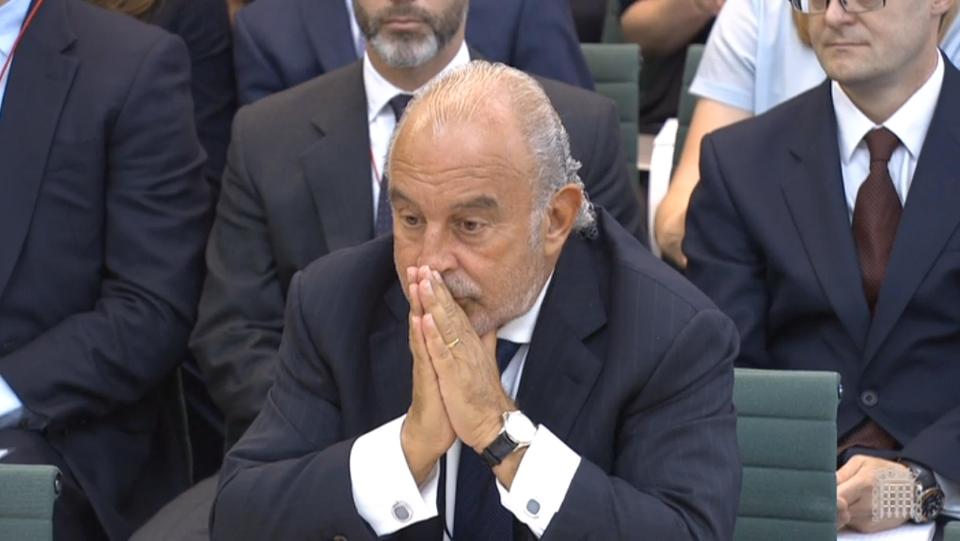

SIR PHILIP GREEN would face a £1 billion bill for the BHS pension scandal under “nuclear” powers proposed by MPs.

A cross-party Commons committee said the Pensions Regulator should be given far more muscle when they chase tycoons for money when they go bust.

Under their plans, entrepreneurs should be threatened with a charge THREE TIMES higher than the amount the regulator wants to plug the shortfall in a company pension scheme.

In the case of BHS, this would have left Sir Philip facing a £1 billion fine given the regulators demand for £350 million.

The Committee also called for the Government to make it mandatory for corporate takeovers to be approved by the Pensions Regulator.

Labour’s Frank Field, the Work and Pensions Committee chair, said: “The measures we set out in this report are intended to reduce the chance of another scheme going down the BHS route.

“It is difficult to imagine the Pensions Regulator would still be having to negotiate with Sir Philip Green if he had been facing a bill of £1 billion – rather than £350 million.

“He would have sorted the pension scheme long ago.”

RELATED STORIES

MPs admit the new powers would never be introduced to hit Sir Philip. But they claim they would act as a meaningful deterrent to others.

The call comes a week after it emerged BHS pensioners have already lost up to 10 per cent of their cash just months after the chain collapsed.

Furious MPs have demanded Sir Philip honour a pledge to “sort” the pensions crisis at BHS – one he made in July.

BHS collapsed earlier this year with a huge pension blackhole 12 months after Sir Philip flogged it for £1 to a twice bankrupt entrepreneur.

Thousands of workers at other high street chains have lost pension savings throughout the credit crisis after seeing their businesses dumped in administration by their owners.

Sir Philip – best known for making a global success of TopShop – is thought to have offered at least £250 million to the pensions regulator.

The Institute of Directors last night welcomed the “timely report”.

Lady Barbara Judge, the IoD’s chair, said: “What happened to BHS pensioners was an outrage and the Committee is right to look at significant changes to the regulatory landscape.”