Universal Credit rollout to be DELAYED as huge changes are planned to help claimants

UNIVERSAL Credit's rollout has been delayed again as ministers make big changes to help claimants, it has been revealed.

Leaked documents reveal Brits could get paid for an extra two weeks to stop them going into debt when going on to the new system.

Millions of people were expected to start being moved over to Universal Credit from their existing benefits last year, but now they might not be put on to it until November 2020, the BBC reported.

Testing was meant to start in January, and 95,000 people each month were set to be told to move across. Now ministers are set to use the time to fix problems in the system - but the programme won't be halted or scrapped.

A series of documents revealed that a whole raft of new changes could be coming to make the transition easier for Brits - if they are signed off by the Treasury.

It comes after a revolt by Tory backbenchers who demanded that extra cash be put in to soften the blow for Brits on benefits.

Plans have been drawn up to spend hundreds of millions of pounds to continue paying some benefits to claimants for two weeks after their new Universal Credit claim has been made.

Housing benefit tenants can already get this two week space, after reports of Brits going into debt at last year's Budget.

The documents also revealed that more help would be given to the self employed, and that the advance payments will be spread out and paid back over a longer amount of time.

Labour's Shadow Work and Pensions Secretary Margaret Greenwood said today the news was proof that the government have "quietly accepted that their flagship social security programme isn't working".

She went on: "The Government must stop the roll out of Universal Credit immediately. We need urgent answers from Esther McVey about what's going on and what action the Government will take to tackle the many flaws in the system."

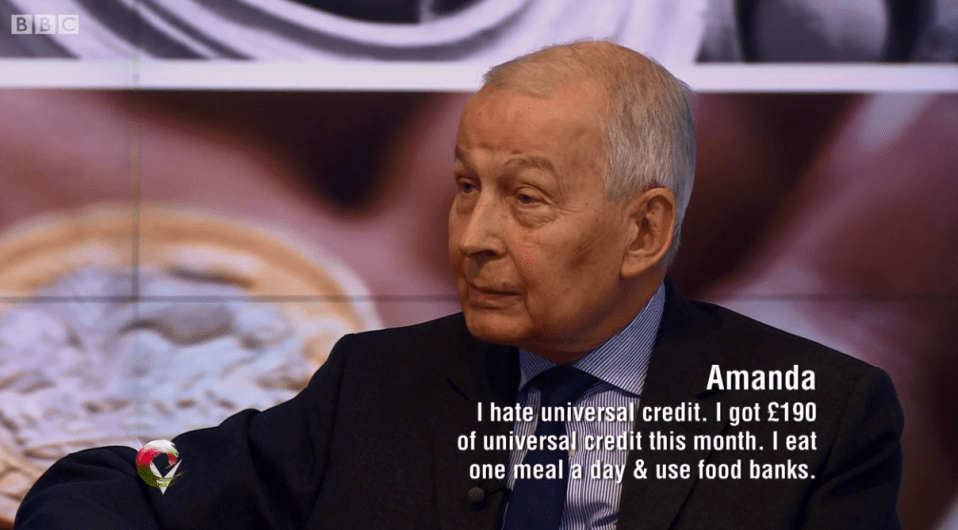

And ex-Labour MP Frank Field said the changes that could take place aren't enough - and demanded "benefits must continue until the new benefit is up and running into your bank account" and that paying back advance payments more slowly should include other historic debts too.

Dame Louise Casey said the design was "flawed from the outset" and it had "pushed people further and further into debt" because it tried to force people to be paid monthly.

She told Radio 4: "The poorest people are often paid weekly and fortnightly - those are the people we need to help... Civil servants are telling ministers this is a mess, and it needs fixing."

What to do if you have problems claiming Universal Credit

If you are experiencing trouble applying for your Universal Credit, or the payments just don't cover it, here are your options:

Apply for an advance - Claimants are able to get some cash within five days rather than waiting weeks for their first payment. But it's a loan which means the repayments will be automatically deducted from your future Universal Credit pay out.

Alternative Payment Arrangements- If you're falling behind on rent, you or your landlord may be able to apply for an APA which will get your payment sent directly to your landlord. You might also be able to change your payments to get them more frequently , or you can split the payments if you're part of a couple.

Budgeting Advance - You may be able to get help from the government to help with emergency household costs of up to £348 if you're single, £464 if you're part of a couple or £812 if you have children. These are only in cases like your cooker breaking down or for help getting a job. You'll have to repay the advance through your regular Universal Credit payments. You'll still have to repay the loan, even if you stop claiming for Universal Credit.

Cut your Council Tax - You might be able to get a discount on your Council Tax or be entitled to Discretionary Housing Payments if your payments aren't enough to cover your rent.

Foodbanks - If you're really hard up and struggling to buy food and toiletries, you can find your local foodbank who will provide you with help for free. You can find your nearest one on the

Even Philippa Stroud, who used to work for the DWP, added that more money needed to be pumped in to offset cuts: "Universal Credit is the right mechanism for delivering welfare, but it needs the investment restored."

Campaigners including Citizens Advice welcomed the proposed moves, but said that it "wouldn't solve all of the problems".

Gillian Guy, Chief Executive of Citizens Advice, said: "If implemented, the measures set out in the leaked document could reduce the risk of greater hardship as a result of moving onto the benefit.

"But Universal Credit is a complex system... The government must make changes to ensure no one is left without enough to get by."

Universal Credit aims to roll six benefits into one monthly payment, but the controversial new programme has been hit by a string of problems.

First announced in 2010, it was meant to be fully up and running by 2017 - this has now been pushed back to 2023.

The new system had also been attacked for taking weeks for claimants to get their first payment, and for stopping domestic abuse victims from leaving their partners as benefits are now only paid into one account per family.

Analysis from Labour revealed yesterday that Universal Credit sanctions hit Brits under 30 the hardest.

MOST READ IN POLITICS

A Department for Work and Pensions statement said today that it would be putting back the rollout.

A spokesperson said: "We have long said that we will take a slow and measured approach to managed migration. This will not begin in January 2019, but later in the year, after a period of preparation.

"For a further year we will then begin migration working with a maximum of 10,000 people, continuing with our ‘test and learn’ approach. This is to ensure the system is working well for claimants and to make any necessary adaptions as we go.

"We will publish full plans for the next stage of Universal Credit rollout, including managed migration, in due course. Anything before that point is speculation and we do not comment on leaks."

What is an advance credit?

STRUGGLING families who can't wait for the money to cover bills can get an advance cash payments to stop them falling in to debt.

Claimants are able to get some cash within five days or on the same day they make a claim in emergency cases - rather than waiting weeks for their first Universal Credit payment.

But the upfront payment is a loan which means you'll have to pay it back.

The repayments will be automatically deducted from your Universal Credit payments after you've taken the loan.

You should ask for the advance if you don't think you'll have enough money to live on between when you apply and when you'll get your first payment.

Have you lost money or had trouble with Universal Credit? We pay for your stories. Email us at tips@the-sun.co.uk or call 0207 782 4368. You can WhatsApp us on 07810 791 502. We pay for videos too. Click here to upload yours